Blog

Mold Removal & Repairs: Who’s Responsible?

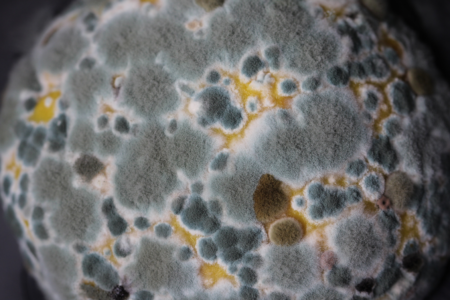

Formation of mold in homes in Florida is quite common due to the humidity and moisture in the air. Mold can damage or destroy a home’s building materials, such as wood and drywall, and contents, such as furniture and other personal belongings. Who is responsible to pay for repairs and replacements? The homeowner or insurance company?

In the majority of cases, the homeowner winds up footing the bill. Especially in a high-risk mold state like Florida, due to its climate, insurance companies intentionally leave mold coverage out of the policy because insurance companies want to pay out as few claims as possible. Although mold can be caused by build-up of excess water, flood insurance does not cover it either.

Homeowners insurance policies do, however, cover mold damage if it was caused by a covered peril, such as fire, lightning, vandalism or malicious mischief, a vehicle, theft, falling objects, or accidental discharge or overflow of water or steam from plumbing, heating, air conditioners, sprinkler systems, or household appliances, according to Insurance.com. Read your insurance policy carefully, or have The Glassman Legal Group do it for you, to see if your homeowners insurance policy does in fact cover mold. Some do, with limitations.

Homeowners can also add an insurance policy endorsement to their policy to cover mold. This is sold a la carte and can cover mold damage and repairs up to a certain amount of money or stipulate which services, repairs, or replacements are covered.

To increase the likelihood that your insurance company will approve your claim, act to rectify the problem immediately and mitigate the issue. Insurance companies will deny your claim if they find out you knew about the cause of or potential for a mold problem developing and ignored it for a while, allowing it to get worse.

Homeowners Associations

Many people in Florida live in a Homeowners Association (HOA). In some instances, HOAs may be responsible for the cost of mold removal and remediation. Familiarize yourself with the bylaws and Florida Statute 718.111(11)(f).

Condominiums are typically responsible for the common elements of a building, including the drywall, roof, and ceiling. However, the unit owner is financially responsible for interior damage. For example, the HOA would take care of the drywall, but the owner needs to re-paint or replace wallpaper as well as furniture, cabinets, water heaters, appliances, light fixtures, and window treatments.

Even if the mold damage was due to work performed by a third party contractor or a leak caused by a neighboring unit, the HOA should still be held responsible for common elements. But, you may need the help of The Glassman Legal Group to fight for you to get what you are rightfully owed.

Health Issues

A lot of clients of The Glassman Legal Group who have been exposed to mold complain about health issues arising as a result. Although there isn’t conclusive scientific evidence that shows a correlation between mold exposure and long term health issues, symptoms people complain about include an allergic reaction–coughing, itchy eyes, sneezing, runny nose, breathing problems, etc. Individuals with allergies, asthma, respiratory illnesses, and those who are immunocompromised are more likely to feel symptoms.

Symptoms could be so severe, they could force occupants to vacate the premises until the mold problem is corrected. Mold can cause not only repair and medical bills, but also the expense of hotel stays and dining out. Documenting symptoms and doctor visits could help in a personal injury claim, but unfortunately doesn’t apply pressure on a homeowner’s insurance company to act quickly. Keep all receipts.

If you’re having symptoms related to mold exposure and the existence of harmful mold is in your home, you may need us to hold your insurance company’s feet to the fire. Call The Glassman Legal Group at (954) 915-8800.

For a comprehensive guide on how mold grows and impacts your health, visit FloridaHealth.gov.